Differential low ebb, less Commission and no euribor plus.

The sector financial Spanish is located in a time only. Unlike what was happening before the crisis, When interests were low but the price of housing was high, buying a property is now more affordable, mainly because these two indicators, price and interest, are found in levels low.

This situation causes a reactivation gradual of the market of the housing. According to the National Institute of statistics, the sale and purchase of housing is increased a 20,5 % year on year in June of 2016. A study by the financial comparisonHelpMyCash.com and analyzed by habitaclia.com shows the advantages that now have mortgages vs. the arrival of 2017.

-Differential more low, reaching its minimum

2016 It may be the last chance of sign mortgages to type variable with differential next to the 1 %. Entities are already transferring all its efforts to improve the range of its fixed rate mortgages and some banks have already begun to raise their variable mortgage differential.

Against what had been going on since 2014, banking has buried the hatchet in respect of mortgage spreads. The reason: the decline and consolidation of the euribor to 12 months in negative values.

Few entities have continued betting by the variable rate after six months with a euribor below zero. Spreads throughout the year sales are counted on the fingers of one hand. Currently, the differential half of those loans mortgage variable round the 1 %, According to data of the comparator.

On the other hand, Although fixed-rate mortgages offer unusual interests, still appear more expensive in the short term. Today is possible to sign a mortgage fixed below the 2 %, but a very short time, less than 10 years. For deadlines more own of the type variable, as they can be 30 years, those interests will rise until the 3 %, practically 2 percentage points above an average differential.

-In 2017, the commissions will be most common

Following the instructions of the Bank of Spain, entities are incorporating more commissions in its financial products. So far, variable rate mortgages not used to include opening Committee, However, each time there are more banks that are setting this tariff, it becomes effective to arrange financing. The Commission can oscillate between the 0 % and the 1 % of the capital borrowed. Like this, for a mortgage of 100.000 EUR, with a Commission from the 1 %, the client must pay an amount of 1.000 EUR.

Currently, There is a fee-free mortgage loans.Like this, If your client is going to sign a mortgage the last months of 2016, This is no doubt another advantage that it saves you interesting.

-The euribor plus more expensive the cost of those mortgages in 2017

According to the European monetary markets (EMMI), This new rate mortgage will see the light in 2017. Everything seems to indicate that its value of contributions will be positive and therefore higher than the current euribor. Like this, sign a variable mortgage months of 2016 supposed benefit from fees more affordable than in 2017, According to HelpMyCash.

It must take into account that the euribor plus is not a new index but a modification of the current. The euribor to 12 months, applied in the 90 % mortgage, are obtained with data estimates of the 24 major banks European. In order to obtain a more reliable and less manipulable indicator, the euribor plus no be based on estimates, but you will get with data real. Sample of entities that data will be expanded.

The euribor plus will apply directly to them new mortgages that is formed in 2017 and it will progressively in mortgage loans referenced to euribor signed before this date.

The advantage of signing a variable mortgage before 2017 It is that we enjoy a year with a lower interest, Since the euribor is listed at the -0,056 %, While the euribor plus quote in positive.

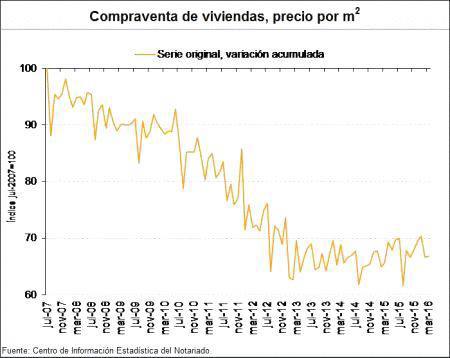

The average price per m2 of housing units sold in March 2016 He was of 1.261 €, that represents a slight increase from the 1.9% year-on-’.

The average price per m2 of housing units sold in March 2016 He was of 1.261 €, that represents a slight increase from the 1.9% year-on-’.